Asking the hard(ware) question: does it really matter?

We analyzed 236,000 luxury resale handbag listings to find out

Hi hi!

Happy pre-Thanksgiving! We’re here with a juicy little deep dive for your long weekend of eating and shopping (and tbh, you might want to keep this data in mind before you hit purchase).

Last week we published our color analysis (to see whether certain colors command resale premiums). Naturally, the next frontier had to be hardware—because to accessorize is to have a preference.

We Analyzed 224K Handbag Sales to Find Out Which Colors Actually Hold Their Value

On Tuesdays we talk data! Today’s topic — does color *actually* influence resale value? Or are we all so beholden to our unique “color seasons” we discovered through TikTok filters that there’s enough demand for each hue? We have our theories, but we thought it was time to put them to the test. Thanks for reading, and as always, subscribe for more mathe…

Not just on handbags, but belts, jewelry, watches, shoes.

Everyone is a hardware person.

Gold girlies, silver girlies, palladium people, brass-haters (as they should be)…

*cue Gretchen Weiners crying about white gold hoops*

But, individual taste aside, we were curious what the market had to say.

The question in question

When comparing identical bags—same brand, model, size, material, condition—which hardware finishes command a premium?

Here’s the simplest example of what we’re measuring. Take a Chanel Classic Flap Medium in Excellent condition:

Gold hardware → sells around $8,500 on average

Silver hardware → sells around $8,200

That’s a –3.5% discount for silver compared to gold.

Same bag. Same everything. Only hardware changes.

The goal: isolate the hardware effect without polluting the results with brand mix, size mix, condition mix, or any other chaos variables.

Methodology

Identical to our color methodology:

Build comparable groups of identical bags.

Compute the average price within each group.

Measure how each hardware finish behaves inside those groups.

Aggregate those effects across the entire market or per brand.

Yes, we apply IQR outlier filtering.

Yes, hardware types with fewer than 1,000 examples get kicked out of the “macro” view so the fringe stuff doesn’t hijack the vibe.

Tables shown below are abbreviated not to bog things down in the nitty gritty.

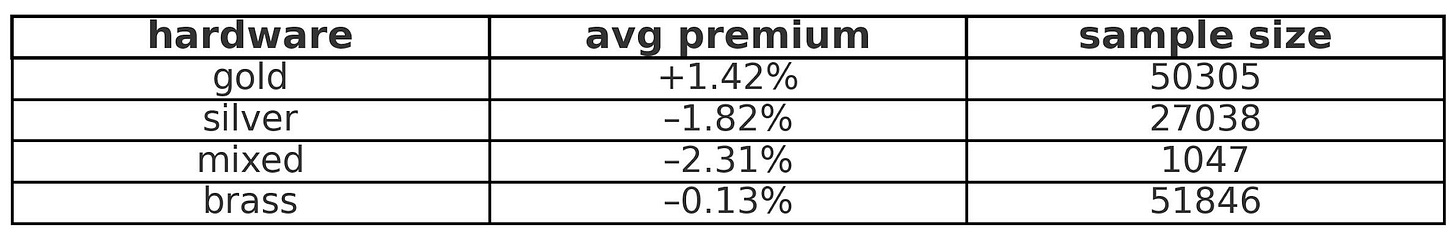

A snapshot of the overall market

Before zooming into brands, we ran a broad sweep across the entire market just to see what directionally pops. Don’t come @ us yet — we know this view is coarse.

But it gives a baseline:

To see what we’re working with: Gold | Silver | Mixed | Brass

Nothing shocking yet. Gold floats upward. Silver dips slightly below. Brass is… brass. Mixed isn’t for everyone.

And now, by brand:

Featuring Chanel, Hermés, and Louis Vuitton

This is where things actually get interesting. Each house has its own hardware culture—and the data shows it.

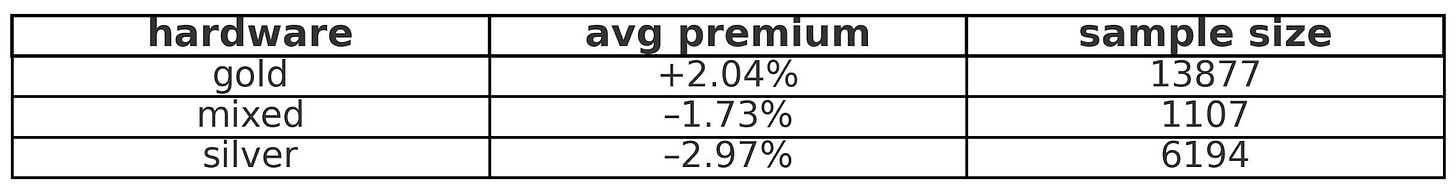

Chanel

Gold wins decisively.

Makes sense—especially in the vintage space. A Classic Flap with 24K plated hardware??? Say less.

Three bags for reference: Gold | Mixed | Silver

Mixed is largely the Chanel 19 (who has been suspiciously MIA lately).

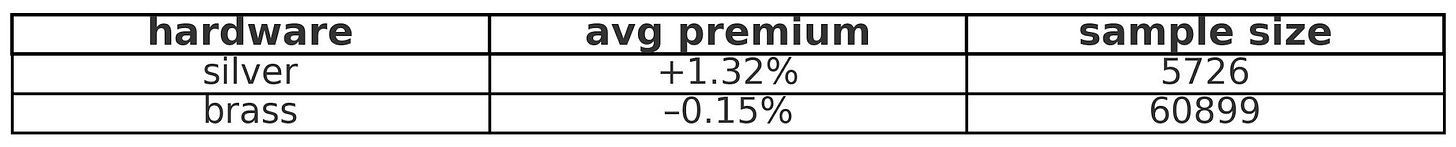

Hermès

Hardware barely matters.

Once we control for everything else, Hermès hardware is basically a non-event. Gold sits around +0.8% and palladium around –1%. These are rounding-error differences.

A spicy outlier: Rose Gold Hardware showed a +13.67% premium — but with only 112 samples. We know it’s harder to find, so the premium checks out emotionally, even if the magnitude would come down with more data.

Louis Vuitton

Hardware finish basically does not affect resale value.

We could see this compress further with a bigger silver sample, but the takeaway is: LV buyers don’t seem to care enough whether a bag has silver or brass hardware for it to meaningfully move price.

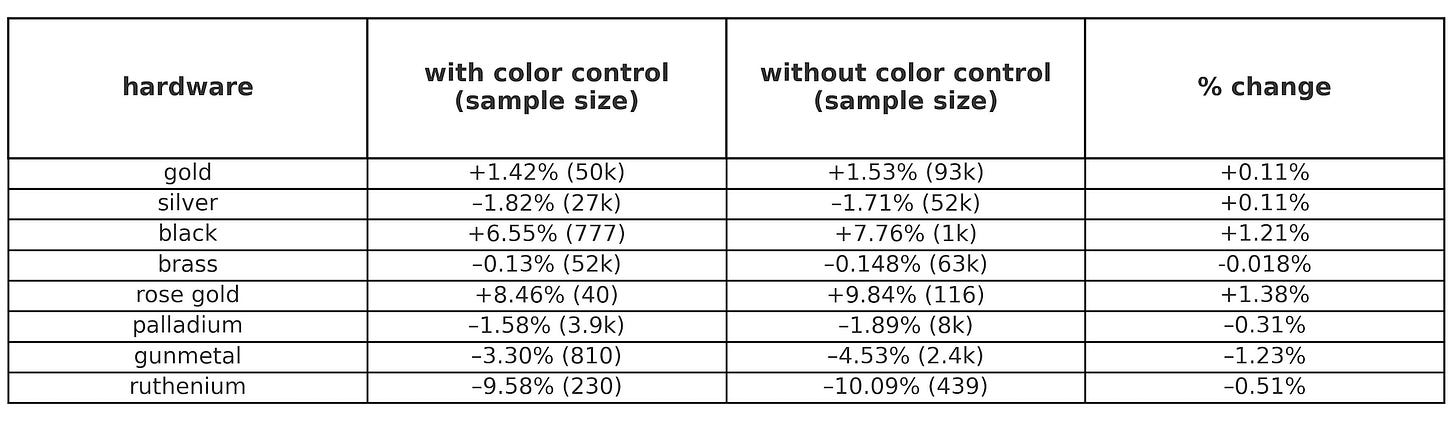

Does controlling for color change anything?

Shockingly… almost not at all.

This might be the most important technical note in the whole analysis.

We ran the methodology twice:

Once with color included in the matching logic (strict)

Once with color removed entirely (looser, way more data)

The results barely changed. At all.

In English, please.

Dropping color expanded the dataset from ~146k to ~236k listings — a 61% jump in statistical power — and hardware premiums barely budged. Gold shifted by –0.02%. Silver by +0.11%.

Meaning: hardware preference is basically independent of color at the macro level. Individual buyers may be picky, but when you zoom out? Those micro-preferences cancel out.

TLDR (but we hope you did read…)

As always: this is for fun.

Buy what you love. Wear what you love. Be a loud and proud silver girlie until the day you die if that’s who you are. If you’re a palladium purist… godspeed soldier. If brass gives you hives, honestly same.

We’re never trying to boss anyone around or imply that your taste should shift because of a couple percentage points in resale premiums. We just love data. We love handbags. And we apparently love procrastinating.

That’s literally all this is.

Hope you enjoyed this little hardware adventure.

If you didn’t… please don’t tell us that.

If you did… there’s always more where this came from.

As a bonus, three Substacks we read this week and loved.

Until next time!! xx

Unfortunately for me, I love gold hardware almost exclusively. This is fascinating research! Thank you for sharing your insights.

Gold all the way - classic